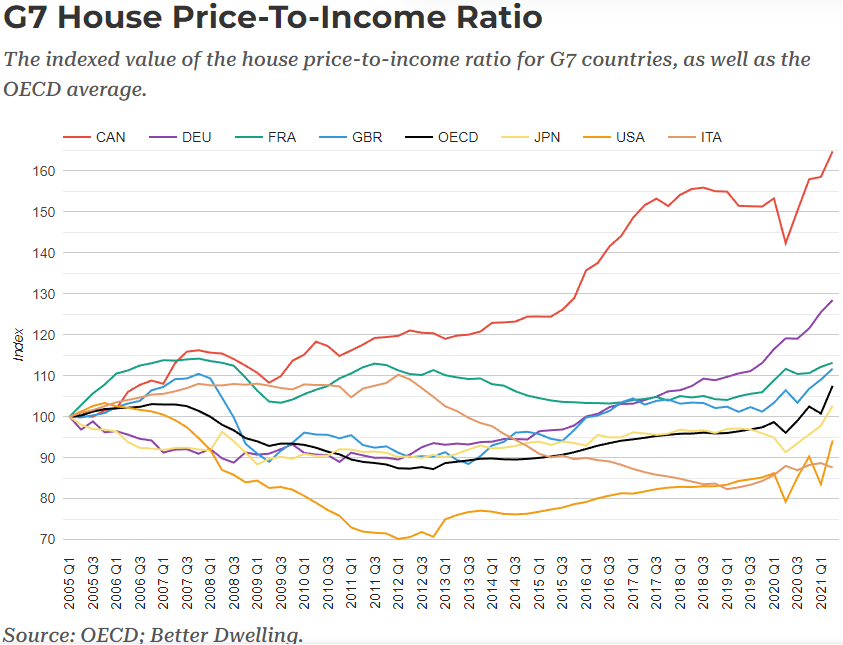

When I first saw this graph, it felt like two sledgehammers hit me in the face simultaneously. The first, and most obvious, is that we are fast approaching having double the ratio of income to home ownership, as the United States and Italy. The second is the meteoric rise in the ratio since late 2015. Why do we not see that same explosion in the other G7 countries? Low interest rates were available around the world, so that cannot explain the difference? The stock markets were blazing hot so there was no need to hedge money in real estate. Perhaps the substantial money coming into Canada from foreign investors played a role? Some of whom were looking to clean money, others hoping to use tax loopholes to avoid paying capital gains. The initial COVID lockdowns began a correction, which was immediately nullified by our government printing great swathes of money, and subsequently throwing it into the wind. Suffice to say, these ratios are not sustainable without serious repercussions on the economy and our quality of life.